NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

Decentralised Finance, or DeFi, is like a new tech revolution in finance. In the past, we mostly used regular banks to keep our money safe and to help with money transactions. But with DeFi, you can handle all this on your own, without needing middlemen or big institutions.

For instance, just like saving money in a bank, you can also keep your crypto on a DeFi platform and get interest from it. The big difference is, that when you use DeFi, you’re in total control of your assets, unlike putting them in a bank.

So, what’s DeFi all about? This article will explore the basics of DeFi, showcasing its operations and the diverse opportunities it presents for maximising your crypto assets.

Decentralised finance, or DeFi, is a new approach to managing financial activities like buying, selling, lending, and making payments with cryptocurrency. Unlike traditional finance where a central authority controls everything, DeFi doesn’t have one central power. Instead, it spreads control among many people, giving more power to individuals.

In traditional or centralised finance, especially in cryptocurrency markets, there’s a main authority overseeing all transactions and often holding the assets. DeFi is different because it operates without this central control, using a peer-to-peer (P2P) approach. This means people can deal directly with each other for their financial activities.

Blockchain is a digital ledger used in DeFi applications. It records financial transactions in code on multiple computers, making the data transparent and hard to alter. This technology offers secure, anonymous transactions and a trustworthy record of who owns what, protecting against fraud.

DeFi also uses something called smart contracts to manage transactions. These smart contracts, often used on Ethereum-based blockchains, automatically carry out the terms of an agreement once certain conditions are met, without needing a middleman.

Here’s a simpler explanation of different types of DeFi applications and why people are engaging with DeFi today:

These DeFi applications use blockchain technology to work without central control, offering new ways to handle financial activities.

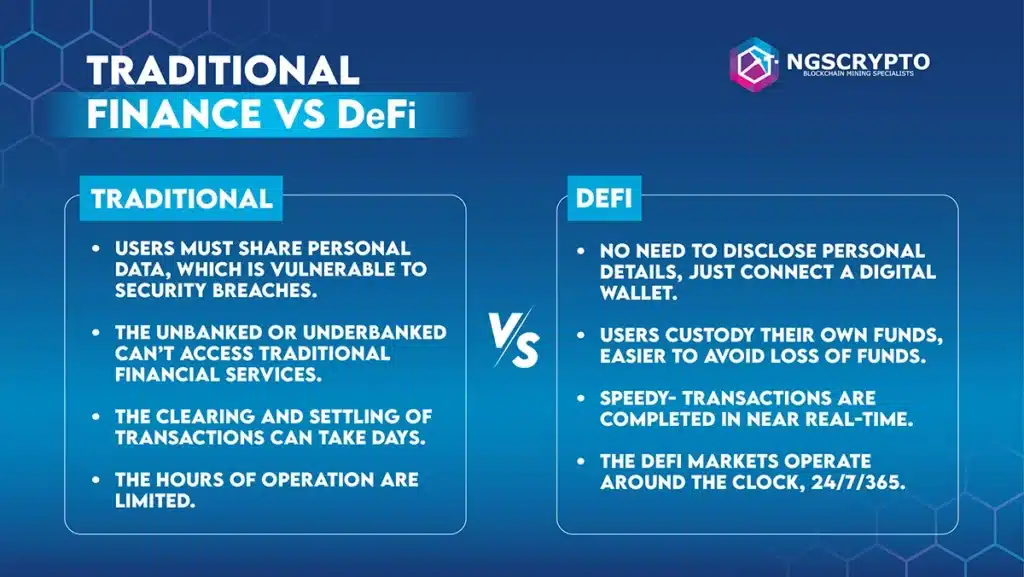

DeFi’s impact on the financial sector has been incredibly transformative. In contrast to traditional finance, DeFi boosts accessibility and efficiency by eliminating intermediaries and harnessing the power of blockchain technology. By integrating blockchain technology, DeFi offers financial inclusiveness, automated efficiency, and worldwide accessibility in ways that were once deemed unfeasible.

Take, for instance, the peer-to-peer essence of DeFi. This means financial transactions and interactions happen directly between parties without needing a middleman. This not only accelerates transactions but also democratises financial activities, allowing individuals to transact and interact on an equal basis, often anonymously or with only minimal personal information required.

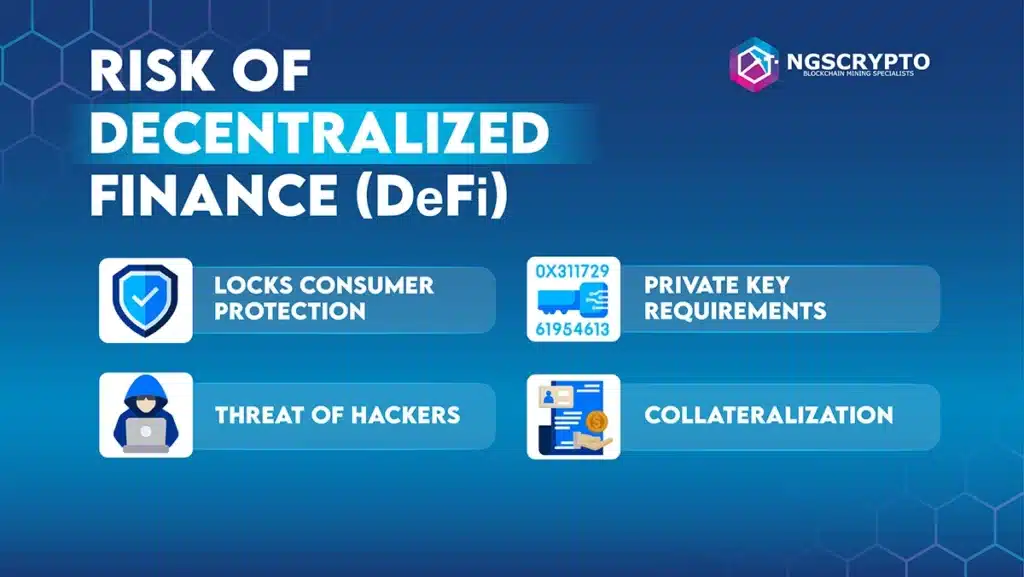

However, despite its numerous advantages, DeFi is not without its risks and complexities. A notable risk is the absence of regulation, potentially leading to an increased risk of fraud, scams, and financial instability. The technology that forms the backbone of DeFi, mainly blockchain and smart contracts, can be intricate and challenging for the average person to grasp.

DeFi, or Decentralised Finance, has experienced remarkable growth in recent years, and 2023 is poised to be a pivotal year for its ecosystem. Thanks to improvements in scalability, increased mainstream acceptance, clearer regulatory guidelines, a boom in decentralised exchanges (DEXs), and new applications, DeFi’s future looks particularly bright. It’s an exhilarating time for the cryptocurrency realm, with DeFi at the forefront of innovation.

The rapid expansion of the DeFi industry is significant. Its progress depends on various factors, including the adoption of blockchain technology, changes in regulatory environments, and ongoing enhancements within the ecosystem. Innovation is central to DeFi’s development. Developers are consistently creating innovative DeFi solutions, like decentralised exchanges, lending platforms, and asset management tools. As these platforms become more user-friendly and accessible, they are expected to attract a wider range of users, thereby boosting DeFi’s overall growth.

The trajectory of DeFi’s future is linked with a complex set of factors. However, with the growing interest in blockchain technology, the likelihood of regulatory developments, and the continuous advancements in the DeFi ecosystem, the industry is on track for significant expansion in the coming years.

As DeFi evolves, it’s worth considering how it intersects with different investment strategies, such as SMSFs investing in cryptocurrency. Find out how Self-Managed Super Funds can navigate the emerging DeFi landscape.

In conclusion, DeFi is changing the finance world by using blockchain technology to remove the need for traditional banks and financial institutions. This makes financial services more accessible to everyone, including those who don’t have access to regular banks. DeFi is also more transparent and secure because it uses blockchain, which keeps a clear and unchangeable record of all transactions. It’s known for introducing new financial products like yield farming and synthetic assets, broadening what financial services can offer.

One of the biggest advantages of DeFi is that it gives users complete control over their money, reducing the need for middlemen like banks. This not only makes things cheaper by cutting out extra fees but also speeds up transactions. DeFi can work across different blockchain platforms, making the financial system more connected. However, it does face some challenges, like unclear regulations and security issues. But overall, DeFi is making finance more inclusive, efficient, and forward-thinking, marking a big change in how we handle money.

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |