NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

Cryptocurrencies have earned a reputation as one of the top-performing investment classes over the past decade, capturing the interest of investors worldwide. With cryptocurrencies becoming more established and subject to regulation, they are increasingly viewed as a credible investment option.

In Australia, individuals who oversee their own retirement savings through Self Managed Super Funds (SMSFs) have begun venturing into cryptocurrencies. This move allows them to diversify their portfolios and potentially benefit from the impressive returns that cryptocurrencies have delivered.

So, is it time to think about investing in this alternative asset class to boost your retirement savings? In this article, we’ll discuss the most frequently asked questions and provide you with all the information you need to get started.

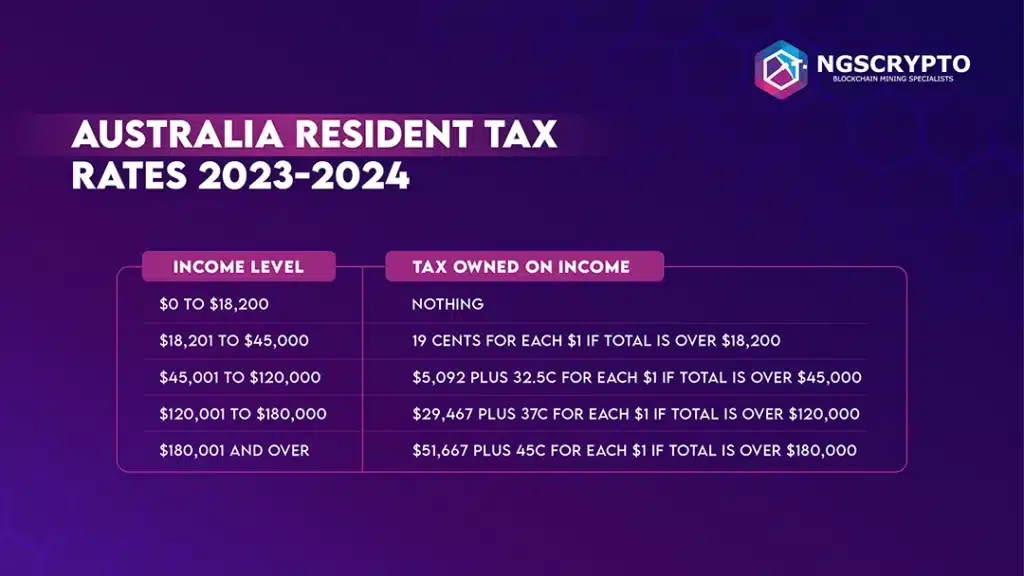

Australia has a relatively generous tax system to work within when it comes to investing in cryptocurrencies. An SMSF is one of the most well-liked options for investors who want to incorporate Bitcoin and other cryptocurrencies into their investment strategy.

The ATO states that SMSFs are permitted to make cryptocurrency investments as long as they:

According to Melbourne superannuation attorney Daniel Butler of DBA Lawyers, it is advantageous to mention cryptocurrency in the trust deed. He claims that by doing this, it will be clear that trustees who want to invest in cryptocurrencies have given themselves explicit authority to do so because they believe it is justified.

While trust deeds that state in their investment powers that an SMSF can invest in any assets that are not prohibited by law should cover cryptocurrencies, Brisbane superannuation strategist Darren Kingdon of Kingdon Financial Group says he has also seen deeds that specifically mention investing in cryptocurrencies.

According to Kingdon, the depiction of cryptocurrency investment within the fund’s investment plan holds as much importance as what’s outlined in the trust deed. A strategy should clearly outline how the fund intends to utilize cryptocurrency assets to achieve its objectives.

Graeme Colley, an executive manager at SuperConcepts, a self-managed superannuation administration firm, notes that guidelines regarding the treatment of cryptocurrency investments are also emerging among SMSF auditors. Auditors now expect explicit mentions of cryptocurrencies in both the investment strategy and the trust deeds. This arises from the perception that auditing these investments is more complex than auditing typical SMSF assets.

Furthermore, the Australian Taxation Office (ATO) suggested that “SMSFs are not allowed to intentionally acquire assets from related parties,” which includes business partners, spouses, and family members. The ATO also mandates that you ensure “the fund’s assets are held separately from your personal assets” within your SMSF.

It dictates that investments in cryptocurrencies cannot represent 90% or more of the total portfolio value within the context of a retirement savings fund, such as a superannuation fund.

This regulatory requirement enforces diversification of investments within the fund, ensuring that a significant majority of the fund’s assets are not concentrated in cryptocurrencies. The primary objective is to mitigate risk and promote a well-balanced and diversified investment strategy within the fund, ultimately safeguarding the interests of the fund’s members.

These ways are to make sure the investment aligns with the fund’s investment plan, trust deed, and regulatory requirements, which state that cryptocurrency investments cannot account for more than 90% of the portfolio’s entire value.

All these guidelines will help SMSFs appropriately add cryptocurrency to their investment portfolios while still being compliant with legal and strategic requirements. Hence, with backing from the present government, numerous Australians aspire to possess or invest in cryptocurrency.

Discover the unique advantages of integrating cryptocurrencies like Bitcoin into your SMSF investment strategy within Australia’s accommodating tax system, and explore the potential of Crypto SMSF with up to 16% annual returns.

Now that you understand the regulatory framework for SMSFs investing in cryptocurrency, you might be curious about other investment opportunities available to SMSFs. Discover a range of options in our guide on: What Can SMSFs Invest In?

According to the most recent data provided to Swyftx by Australian research company YouGov, out of the aforementioned percentage, at least 4.5 million Australians are proven to be in possession of cryptocurrency.

There are several reasons why a lot of Australians have become cryptocurrency owners and investors:

The decreasing yields for bonds and term deposits due to lower interest rates have forced investors to search for returns in other asset classes. For example, the DeFi sector offers various financial services, such as lending, borrowing, and trading, without traditional intermediaries like banks. These platforms often provide significantly higher yields or returns on investments compared to traditional financial products. Or investing in other cryptocurrencies like Bitcoin etc.

Bitcoin is being recognized as a “store of value” asset, similar to how gold has traditionally been used. A store of value is an asset that retains its worth over time and can be relied upon to preserve wealth. Bitcoin’s uniqueness lies in its lack of correlation with other traditional investments like stocks (equities) and bonds.

With inflation fears rising that have historically seen demand for gold grow, much of that demand has moved to Bitcoin instead. This shift is happening because they view Bitcoin as a digital version of gold that has several advantages, including being easily transferable and having a fixed supply. With a fixed supply of only 21 million bitcoins, this trend is set to continue.

During the accumulation phase of their investment journey, many investors are more open to embracing higher levels of risk. This willingness is grounded in the understanding that time is on their side, allowing them to weather market fluctuations. In this phase, the primary focus is on growing investments and making regular contributions.

What makes this phase particularly enticing is the potential for “significant returns.” In other words, investors are drawn to the prospect of achieving considerably higher investment returns compared to more conservative or low-risk options. They are willing to accept a higher degree of risk in exchange for the possibility of substantial gains in the future.

Dive into the world of SMSF cryptocurrency mining and discover how we can use blockchain technology to achieve higher investment returns. A strategy that allows you to earn up to 16% per annum.

A significant majority of Aussie crypto owners say they have profited from their cryptocurrency. In total, 64% of Australians reported making money on their crypto in the last 12 months compared to 72% last year. Aussie cryptocurrency consumers seem to be growing increasingly optimistic about the industry’s future.

According to Swyftx by Australian research company YouGov survey, there is now more long-term trust in blockchain technology. The future of online financial transactions is cryptocurrencies, according to 31% of Australian people and almost 1 million Australians expressed their likelihood to enter the cryptocurrency market for the first time in the next 12 months.

To sum it up, investing in cryptocurrency within Self-Managed Superannuation Funds (SMSFs) promises an exciting journey into the financial future and the potential for substantial profitability. As digital assets continue to reshape the investment landscape, SMSF investors are well-placed to take advantage of the opportunities offered by cryptocurrencies.

With careful planning, thorough research, and compliance with regulatory guidelines, the potential for remarkable returns awaits those who embark on this innovative and profit-driven investment path within the world of SMSFs and crypto.

Exploring cryptocurrency for your SMSF is just one piece of the retirement puzzle. To understand the full spectrum of retirement income streams available in Australia, read our detailed exploration in Best Retirement Income Streams in Australia.

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |