NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

The crypto market has thousands of different digital coins. Each one is unique and can be hard to understand. Bitcoin, a well-known type, was made to be like money, but it’s not legal everywhere. Because of this, most of the other types of crypto aren’t used as money. Instead, they are used for other things like investing or in technology called blockchain.

The continual emergence of new cryptocurrencies is fuelled by people’s desire not to miss out on potential financial gains. With an ever-growing array of cryptocurrencies on offer, it becomes more complex to discern their differences. This article will delve into the different types of cryptocurrency – Coins, Tokens, and Stablecoins – and explore their distinct features.

Cryptocurrencies are digital currencies that are extremely secure due to advanced coding, which makes them nearly impossible to counterfeit or misuse. They are unique because they are decentralised, meaning they are not controlled by any single authority like a government. Instead, they operate on a blockchain system, a type of record-keeping technology that is spread across many computers. This decentralisation is key, as it keeps them independent and less likely to be affected by government policies.

In simple terms, cryptocurrencies are digital forms of money that operate on a network distributed across numerous computers. This decentralised structure is critical, as it allows them to function outside the control of governments and central authorities. Their independence from traditional centralised systems is what sets them apart in the financial world.

In cryptocurrency, it’s crucial to differentiate between a “coin” and a “token,” as they serve different purposes. A digital coin, like Bitcoin or Litecoin, works similarly to traditional money and is created on its unique blockchain network. It’s used for transactions and as a digital form of saving.

On the other hand, tokens, such as Ether used in the Ethereum network, are more versatile. They are developed on existing blockchains and can do various tasks in computer programs, like granting access to an application, verifying identity, or tracking items. Tokens can also represent unique digital items, like NFTs, and are sometimes linked to real-world assets like artwork or real estate.

The easy explanation is cryptocurrency coins and tokens are different types of digital money. Coins have their system (blockchain) and are used like money. Tokens use someone else’s system and help run special apps (decentralised applications).

Cryptocurrency has become increasingly notable for its ability to transform financial dealings and e-commerce.

Here are some of the key cryptocurrencies and their main uses:

Bitcoin (BTC):

Ethereum (ETH):

Ripple (XRP):

As we delve into the blockchain technology that powers cryptocurrencies like Bitcoin and Ethereum, it’s crucial to also consider the environmental impact of cryptocurrency.

Tokens in the cryptocurrency world have a variety of uses, each offering unique functionalities and opportunities. Here are some of the crypto tokens that are popular:

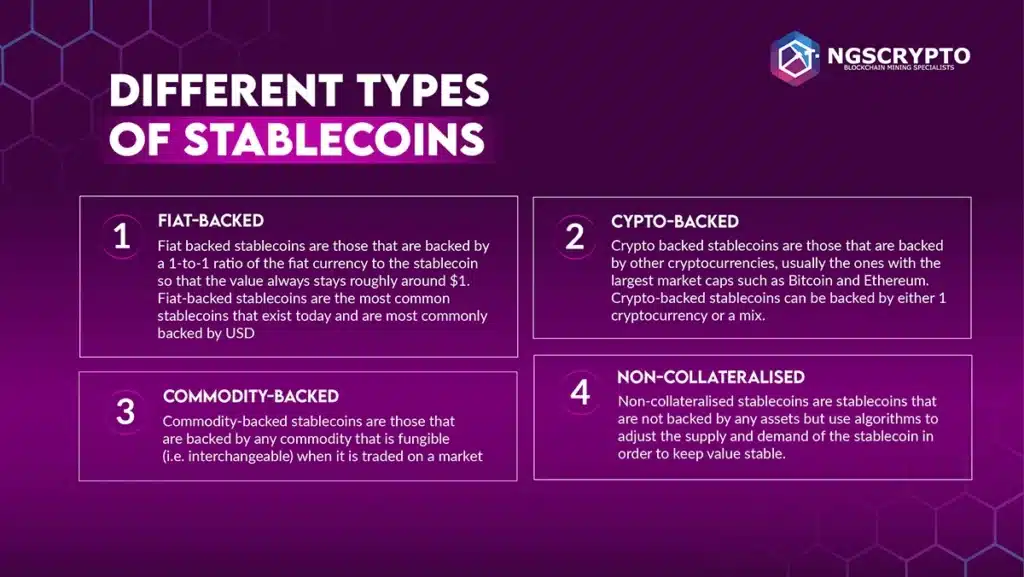

Stablecoins are digital currencies designed to keep a steady value, unlike other cryptocurrencies that often change in price. They do this by having real assets as backup. This stability is useful for crypto traders, especially when the market is unpredictable, helping them protect their money.

What sets stablecoins apart from other digital tokens is their focus on being stable and safe, with their value backed by actual assets. Their amount in the market can change depending on how the market is doing. Companies, including big banks and tech giants like Facebook, are creating their stablecoins, like JP Morgan’s JPM Coin and Facebook’s LIBRA.

This is just a fraction of the existing cryptocurrencies that we discuss. Thousands of digital currencies are revolutionising the digital economy through blockchain technology. Bitcoin is at the forefront, gaining popularity with younger consumers.

However, the ongoing innovation in blockchain isn’t just about creating new currencies. Platforms like Ethereum are becoming significant as they facilitate the development of new software and the emergence of stablecoins, which are increasingly popular nowadays.

With the rising popularity of digital currencies, it’s essential to be aware of potential risks. Learn more about cryptocurrency scams and how to identify them to stay safe in the digital economy.

This evolution is enticing for investors looking to the future. Decentralised blockchain technology could potentially remove intermediaries in business transactions and make global payments more efficient.

Are you ready to take the next step? Learn more about How to Buy and Invest in Cryptocurrency: A Step-By-Step Guide.

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |