NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

Are you considering delving into the world of cryptocurrency investment, yet finding yourself uncertain about how to make your first purchase or initiate your investment journey? Rest assured, you’ve landed in the right place.

Cryptocurrencies have garnered significant attention among Australians, primarily due to their impressive investment yields. It’s no surprise that many individuals are keen on setting up digital currency exchanges nowadays. If you’re new to the realm of cryptocurrencies and feeling somewhat overwhelmed, don’t worry.

The world of crypto may initially appear intricate and intimidating, but in reality, grasping the mechanics of exchanges and the fundamental principles behind your investments requires some initial groundwork and research before you take the plunge.

To assist you in embarking on your crypto journey, NGS Crypto will share a comprehensive, step-by-step guide to help you navigate the process of purchasing and investing in cryptocurrency.

The latest Swyftx survey on digital assets in Australia reveals that the adoption of cryptocurrencies continues to climb. Australia now boasts the highest rate of cryptocurrency adoption (23%) among developed nations and ranks eighth globally. Currently, an estimated 4.5 million Aussies are crypto holders.

Based on a Forbes Advisor survey, many Australians invest in cryptocurrency for different reasons. Half of them answer that it is an easy way to start investing, especially with simple mobile apps and feel it’s simpler than traditional investments. Others are motivated by their belief in what cryptocurrency stands for and like the ease of accessing their money and the rest of them answer that they have seen better returns with crypto than with traditional investments.

So which cryptocurrencies are popular among Aussies? Bitcoin is the top pick in Australia because it was the first crypto, everyone knows it, and it’s easy to buy and sell. It’s also seen as a safe place to store value, like gold, and many big investors are into it. Plus, there’s only a limited amount, which can make it more valuable over time.

Crypto experts believe that Bitcoin, currently around $30,000, has a chance to bounce back or drop to $28,000 if it falls below that level. There’s optimism about Bitcoin’s future due to the upcoming 2024 Bitcoin halving event, which occurs every four years and historically has boosted Bitcoin’s price by reducing mining rewards and tightening supply.

Although there are compelling reasons to invest in cryptocurrencies, such as their potential for high returns and ease of access, it’s important to weigh these against the risks involved. For a more in-depth look at both sides of the coin, consider reading our article on the Advantages and Disadvantages of Cryptocurrency.

A cryptocurrency exchange is a platform where buyers and sellers meet to trade cryptocurrencies. These exchanges typically offer modest fees, but their interfaces can be intricate, featuring a variety of trade options and some rather sophisticated performance charts.

It’s important to remember that each individual brings their own unique set of preferences and trading objectives into the equation. These personal factors ultimately guide the choice of exchange. Some people seek a broad array of cryptocurrencies, while others aim for the convenience of an Australian-based platform with tailored customer support. The primary factors to consider while selecting an exchange are:

Once you’ve decided on an exchange, creating a crypto account is simple and straightforward, and most exchanges use a similar procedure. Here is the procedure:

Firstly, newcomers should register with the exchange, which sets up a user account and crypto wallet for easy transactions.

Users sign up by providing their email address, selecting a password, and agreeing to the exchange’s terms and conditions.

Passwords should be sufficiently strong to keep your account information and any money in your wallet secure. many exchanges offer password guidance, so it’s wise to heed their suggestions.

Users should update their account details by going to the ‘Security’ section in ‘My Account’ to keep the account safe. Turning on email and/or mobile verification for transactions will ensure users receive notifications about their account activities.

Exchange apps also encourage their users to set up two-factor authentication. This adds extra security to their accounts by asking for a special, time-sensitive code (sent to their mobile or email) every time they log in.

There are three common KYC in exchange apps. Here are the three KYC:

These are the simple three procedures of signing up for a crypto exchange account, but please remember that each crypto exchange app may have its own unique sign-up process. So, be sure to read and complete all the details carefully.

Navigating the legalities of cryptocurrency can be complex. To ensure you’re fully informed about the legal framework surrounding your investments, read our comprehensive guide on Is Cryptocurrency Legal in Australia, which will clarify the legal standing of cryptocurrencies in the country.

To acquire cryptocurrencies, you must first ensure there are funds available in your account. You can add money to your crypto account either by connecting your bank account or by initiating a payment using a debit or credit card (please be cautious of potential elevated fees associated with credit card payments).

After creating your account and completing identity verification (KYC), log in to your account. In your exchange account, navigate to the “Deposit” or “Funding” section. When depositing money into your cryptocurrency exchange account, you’ll have several payment methods to choose from:

Depending on your chosen payment method, you will need to provide the necessary details, like bank account information for bank transfers or card information for card payments. Specify the amount you want to deposit, review the details carefully, and confirm the deposit. The processing time for deposits can vary, so monitor your account for confirmation. Once your funds are available, you can start trading cryptocurrencies on the exchange.

Here are the steps to locate Bitcoin on your chosen exchange, specify the amount you want, review transaction fees, and confirm the purchase:

Keep in mind that the specific steps might vary slightly depending on the exchange you’re using. Always ensure that you’re using a reputable and secure exchange and adhere to their guidelines for buying and storing cryptocurrencies.

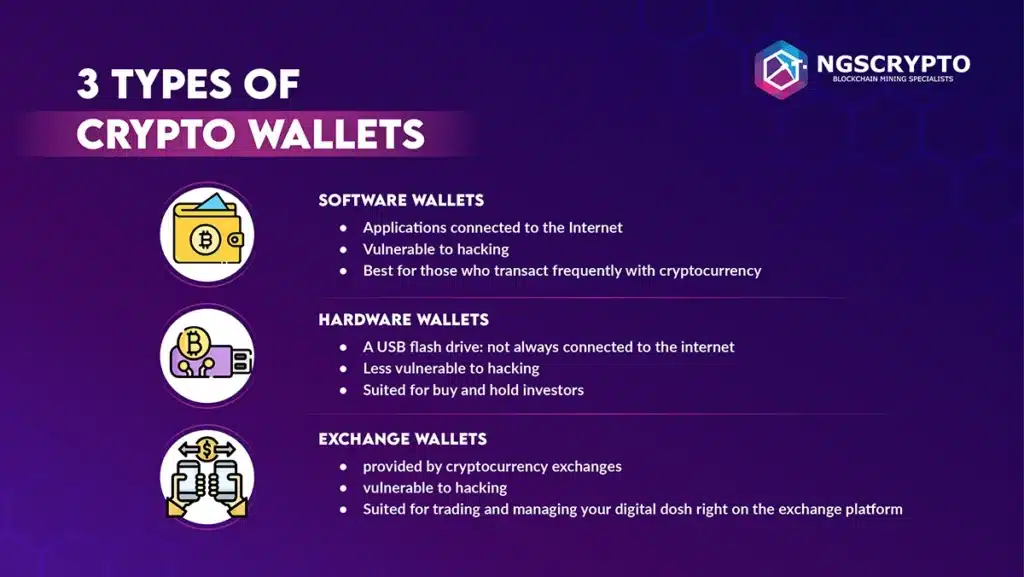

If you want to transact on cryptocurrency like Bitcoin or others, you will first need a palace to store all your crypto safely. This storage location is called a cryptocurrency wallet. There are three different types of wallets:

In the world of blockchain tech, a hardware wallet is a type of crypto wallet that secures private keys on a physical device, often like a USB drive. These hardware wallets are a bit of a mix between ‘hot’ and ‘cold’ wallets.

Hardware wallets help you stash your private keys safely offline, where hackers can’t get at them. Plus, many hardware wallets allow you to confirm blockchain transactions by simply plugging the device into your computer.

Once the transaction is done, you can unplug it, and you don’t have to worry about it being constantly online, which can make a wallet an easy target for threats. There are a couple of the big names in hardware wallet providers, including Ledger and Trezor.

Aussies love using software wallets in the crypto world. These wallets are always online, making it super easy to get into DeFi action. You can borrow, lend, stake, swap tokens, and trade on DEXs with ease.

But there’s a risk. Since these wallets are always online, they’re like open doors for potential hackers. And it’s not just online risks, if you lose a device with your wallet on it, someone could easily hack and take your crypto. So, always lock your device with a strong password to stay safe.

There are three main types of software wallets:

For extra security, use two-factor authentication for both mobile and desktop wallets.

Exchange wallets are crypto wallets provided by cryptocurrency exchanges. They’re handy for trading and managing your crypto right on the exchange platform. It’s like having a wallet tied to your exchange account, making it easy as pie to buy, sell, and swap cryptocurrencies.

But keep in mind, that these wallets are usually less secure than other types, such as hardware or software wallets, because they’re controlled by the exchange and can be a target for hackers. Many users move their assets to more secure wallets when they’re not in the middle of a trading frenzy.

In this article, we’ve navigated the exciting terrain of cryptocurrency investment in the Australian context. Our journey has unveiled the motivations behind Australian interest in cryptocurrencies, from diversifying investment portfolios to embracing digital innovation.

We’ve emphasized the importance of selecting secure and compliant exchanges, as well as the significance of identity verification and financial planning. While you embark on your cryptocurrency journey, keep in mind that each exchange may have unique procedures, so choose carefully.

We’ve also provided a detailed roadmap for buying Bitcoin and highlighted the crucial aspect of secure storage. This guide aims to empower people to participate in the cryptocurrency landscape with confidence, understanding the nuances and necessities of responsible investment. With a firm foundation in security, compliance, and informed decision-making, this guide equips you for a successful cryptocurrency investment journey in Australia.

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |