NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

Blockchain technology has changed how we handle transactions and keep data safe. But, it’s pretty famous for a big hurdle known as the blockchain trilemma.

Think about balancing your social life, work, and getting enough sleep – it’s tough to keep up with all three, right?

This trilemma in the blockchain world is a bit like that.

A lot of blockchain networks are great at one or two things, but we haven’t yet seen one that’s ace at all three.

That’s why getting your head around this “Blockchain Trilemma” helps you appreciate what each blockchain is trying to achieve in its way.

Blockchain is a distributed ledger backed by a decentralised network of computers around the globe, recording economic transactions and addresses.

This means there are multiple copies spread across the network, and they all have to line up for a record to be legit, which makes it tough for anyone dodgy to change a record in the blockchain.

However, for blockchain tech to take off, it needs to handle more data and do it faster, without getting too slow or costly to use.

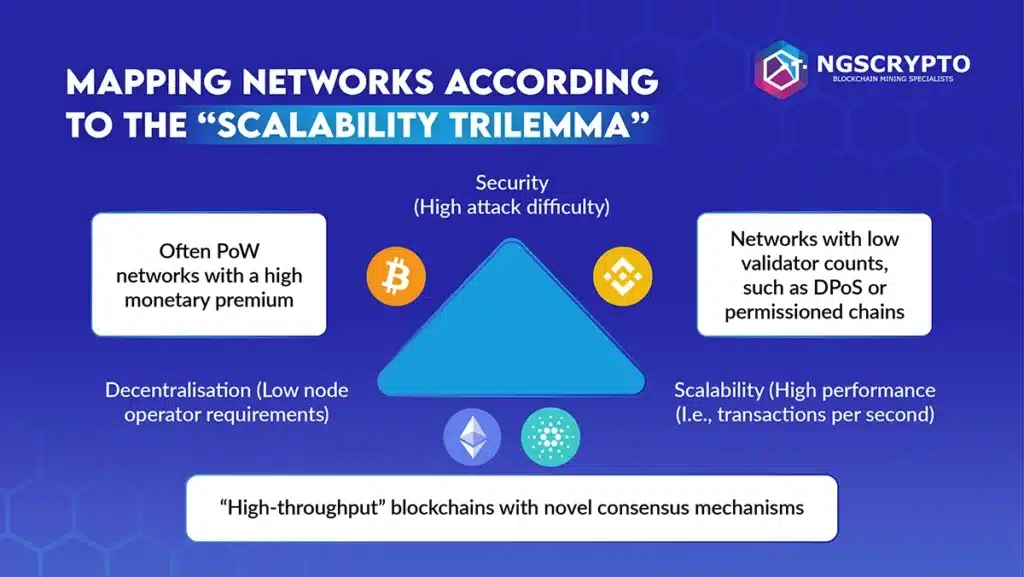

The blockchain trilemma, a term cooked up by Vitalik Buterin, points out three big challenges — decentralisation, security, and scalability — that developers face when making blockchains.

It’s a common belief that decentralised networks can only offer two out of three perks at any one time when it comes to decentralisation, security, and scalability.

But, there’s heaps of innovation happening in the decentralised space, with a mix of Layer-1 and Layer-2 solutions coming up that are smashing through these barriers to sort out the trilemma once and for all.

When we focus on the first key element of the blockchain trilemma, we quickly recognise that security takes center stage in the world of blockchain technology.

The creation of a blockchain network demands the implementation of robust defence mechanisms to deter any malicious actors attempting to gain control. This challenge is intricate, particularly due to the inherently decentralised nature of blockchains, where there’s no central authority overseeing and safeguarding the system.

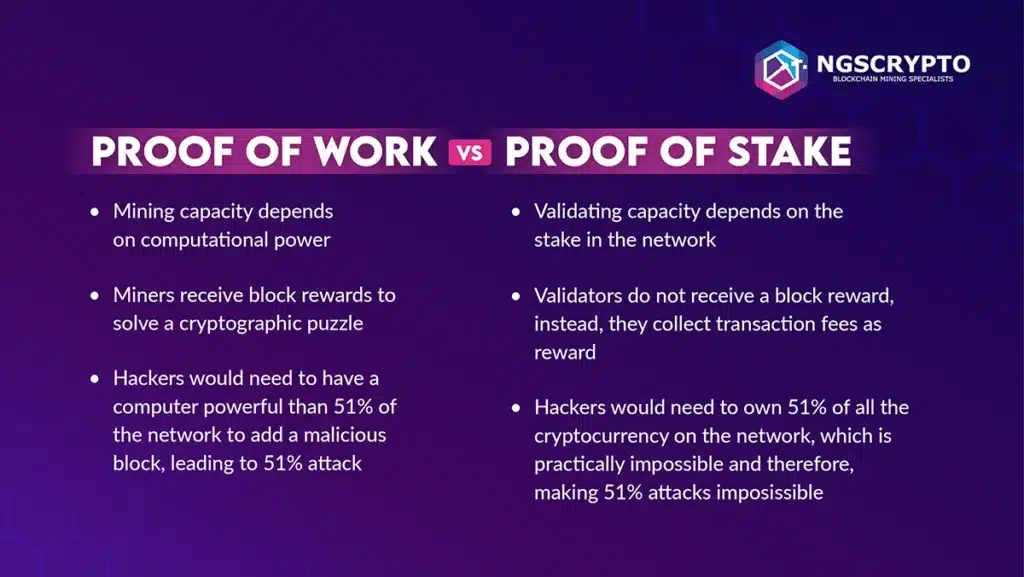

To ensure security, let’s take a closer look at the example of the Bitcoin blockchain. It employs a combination of advanced cryptography and a consensus mechanism known as proof of work.

Through this intricate mechanism, each block of data interconnects in a tamper-resistant manner, making it exceedingly difficult for anyone to tamper with the data without immediate detection by the network.

Furthermore, the security of the system is enhanced as the number of participants or nodes in the network increases.

This is because a higher number of participants makes it significantly more challenging for a single entity to gain control, effectively mitigating potential threats such as the well-known 51% attack.

However, it’s vital to bear in mind that, despite the paramount importance of security, it is closely intertwined with the other two facets of the trilemma: decentralisation and scalability.

Strengthening security can sometimes necessitate trade-offs that impact these other dimensions of blockchain technology. Balancing these aspects is a critical consideration in blockchain development.

Given the global ambitions of many blockchain projects, it becomes imperative that their networks are architected to accommodate potentially billions of users.

However, achieving robust scalability is a formidable challenge, particularly when attempting to uphold the other two pillars of the trilemma: decentralisation and security.

In the pursuit of bolstering decentralisation and security, scalability often presents a formidable hurdle.

Take, for example, the Bitcoin network, which can currently handle only approximately seven transactions per second.

This figure starkly contrasts with centralised payment systems like Visa, capable of processing 24,000 transactions per second.

The primary reason for this contrast lies in the fundamental design of blockchain networks, where data processing necessitates the involvement of multiple participants, and consensus mechanisms like proof-of-work, though secure, tend to be sluggish.

Numerous solutions are currently under exploration to address this challenge, including sharding, alternative consensus mechanisms, and the implementation of Layer 2 solutions.

These innovations aim to strike a balance between scalability, decentralisation, and security within the realm of blockchain technology.

Decentralisation is a defining feature of blockchain technology, distinguishing it from conventional centralised systems.

In a decentralised blockchain network, control is equitably dispersed among all participants, obviating the necessity for a central authority. This equitable distribution of control not only amplifies network transparency and impartiality but also bolsters its resistance against censorship and external manipulation.

However, attaining decentralisation comes with its own set of challenges.

As the number of participants within the network increases, reaching a consensus can become more time-intensive, impacting the network’s scalability.

Additionally, a highly decentralised network might experience decreased security if it becomes easier for malicious actors to infiltrate and launch attacks.

The three pillars of the blockchain trilemma — decentralisation, security, and scalability — are closely interconnected, and enhancing one often impacts the others. Let’s explore how this happens with examples from real-world blockchain networks:

Scalability is about the network’s ability to handle a large number of transactions.

Increasing scalability can sometimes compromise security.

For example, Ripple is a blockchain platform built for the finance mob, offering quick and efficient payments across borders. However, Ripple’s network is a bit more centralised compared to other blockchain networks, which could make it a bit easier for censorship control.

To deal with the scalability issue, Ripple has gone for a different consensus mechanism.

Not like Bitcoin or Ethereum, Ripple’s blockchain has a shorter list of validators who are on the job of verifying and confirming transactions.

Security in blockchain involves protecting the network from attacks and ensuring the integrity of the transaction ledger.

However, enhancing security can sometimes reduce decentralisation.

For example, Ethereum’s move to a proof-of-stake (PoS) consensus mechanism (Ethereum 2.0) aims to improve security and scalability.

However, it could potentially centralise control to those who hold large amounts of the currency, as they have more power in the network.

Each of these examples demonstrates the trade-offs and interconnections between the pillars of the blockchain trilemma.

Read more: What Is DeFi In Crypto?

The community has witnessed several innovative approaches taken by these developers, resulting in intriguing outcomes. Let’s delve into some of the most prominent techniques to tackle the Blockchain trilemma

This involves splitting databases into smaller blockchains called Shards to ease the load on a single blockchain. It helps with scalability but doesn’t fully solve the trilemma.

The traditional proof of work system offers high security but limited scalability. Developers are exploring alternatives like proof of stake (PoS) to balance security and scalability. For example, Ethereum has already shifted to PoS.

These are solutions built on existing network structures. They include side chains, which are separate chains connected to the main blockchain, and state channels, which use smart contracts to process transactions without clogging the main chain.

The Blockchain Trilemma, encompassing decentralisation, security, and scalability, continues to pose a challenge in the current state of blockchain technology.

Striking a balance between these three aspects remains a central focus, with ongoing efforts to enhance decentralisation, strengthen security measures, and address scalability issues through innovative solutions like sharding and layer 2 protocols.

The future of blockchain technology holds promise, with increasing interoperability, regulatory frameworks, and expanding use cases across various industries.

As blockchain continues to evolve, its potential to revolutionise processes, improve transparency, and drive adoption remains a compelling outlook for the technology’s future.

Read more: The Ups and Downs of Cryptocurrency: Why Is Crypto So Volatile?

References:

Blockchain Council. (n.d.). Blockchain Trilemma: Is It Inevitable With Blockchain? Retrieved February 2, 2024, from https://www.blockchain-council.org/blockchain/blockchain-trilemma/

Musharraf, M. (2021, November 15). What is the Blockchain Trilemma? Ledger. Retrieved February 2, 2024, from https://www.ledger.com/academy/what-is-the-blockchain-trilemma

Crooks, N. (2023, September 19). What is the blockchain trilemma? The Block. Retrieved February 2, 2024, from https://www.theblock.co/learn/249536/what-is-the-blockchain-trilemma

Cole, A. (2024, January 10). What Does The Blockchain Trilemma Look Like in 2024? Techopedia. Retrieved February 2, 2024, from https://www.techopedia.com/what-does-the-blockchain-trilemma-look-like-in-2024

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |