NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

NGS Crypto is an Authorised Reseller of NGS Group Blockchain Mining Packages

Written by Katya Richardson

Share this article

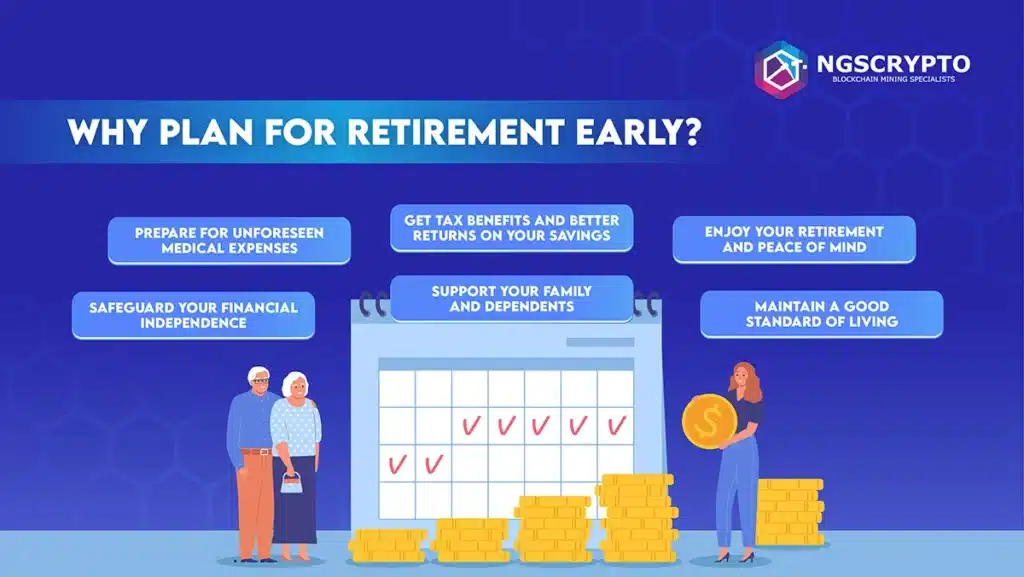

A lot of people are interested in learning about retirement planning. They desire a good start and the assurance that their golden years will be comfortable. If you’re in the same situation, planning your retirement from now on can be very helpful.

Why should you consider retirement planning? Planning for retirement is crucial for ensuring your financial stability. With your plan’s assistance, you can determine your risk tolerance, required investment return, and portfolio withdrawal strategy.

In this article, we will provide a systematic guide to help you proactively plan for a financially secure retirement, ensuring that you do not face financial challenges in your post-retirement years.

Two crucial figures you should be aware of are your Preservation Age and your Qualifying Age. It’s essential to understand the significant distinction between these two.

| Birth Year | Age You Can Access Your Super |

| Before 1 July 1960 | 55 |

| 1 July 1960 to 30 June 1961 | 56 |

| 1 July 1961 to 30 June 1962 | 57 |

| 1 July 1962 to 30 June 1963 | 58 |

| 1 July 1963 to 30 June 1964 | 59 |

| 1 July 1964 or After | 60 |

| Birth Year | Age You May Qualify For The Pension |

| From July 1952 to 31 December 1953 | 65 years 6 months |

| From January 1954 to 30 June 1955 | 66 years |

| From 1 July 1955 to 31 December 1956 | 66 years 6 months |

| On, or After 1 January 1957 | 67 years |

Deciding when you intend to retire is a significant choice on your financial path. It requires defining precise retirement objectives and creating a schedule for your retirement strategies.

The timing of retirement can fluctuate considerably from one individual to another, and it is impacted by various factors, including your financial preparedness, personal ambitions, and life circumstances. Elements such as your job prospects, your physical well-being, and your family circumstances, could also affect your choice.

When deciding when to retire, there are factors to think about, but no strict guidelines. Here’s a checklist to help:

How much money you’ll need for living costs in retirement depends on your lifestyle priorities and what you can afford.

Your retirement income will come from superannuation. If you have little super, you will rely more on the pension. If you have super, consider when and how to withdraw it. You may also have savings or investments.

Work out your living costs

Consider:

As a general guideline, consider budgeting for about two-thirds of your present living expenses. This benchmark is helpful because it considers lower work costs and assumes you have finished paying your mortgage.

Decide what matters most. Consider how your lifestyle will feel and appear. What are the most important things?

Think about your living expenses, for example:

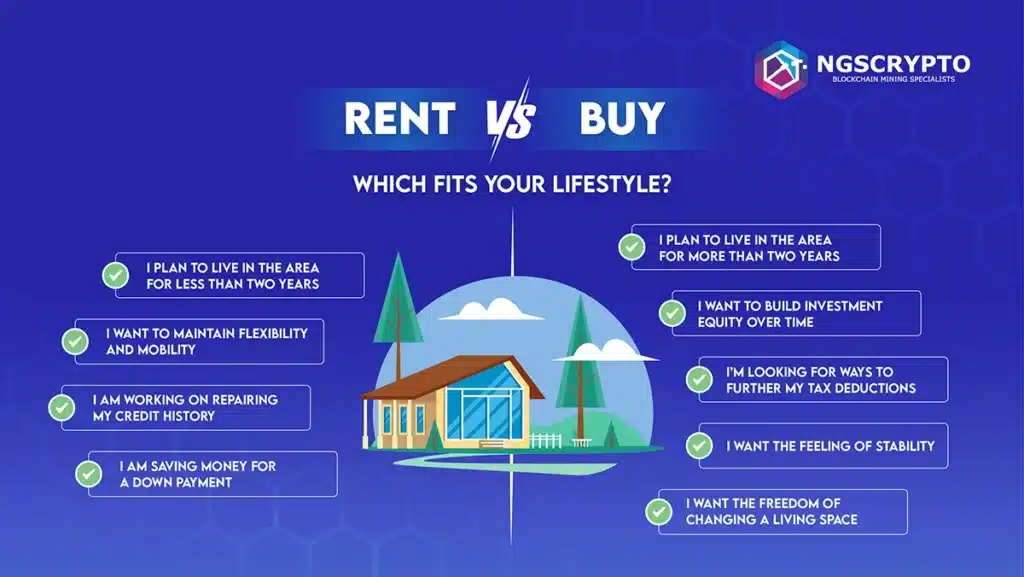

Make plans for where you will live. For example, if you own your home:

Should you be renting:

Three primary sources of possible retirement income include your super, the Government Age Pension, and any assets you possess.

Even when you reach your preservation age, you can keep your super working for you. Depending on your circumstances, whether you want to retire or keep working, there are options to consider.

Account-based pension – paying yourself from your super. Did you know you don’t need to take all your super out at once? The option of an account based pension allows you to draw a regular income from your super while it continues to stay invested. You can also access extra money whenever you need it.

As of March 26, 2021, around 62% of Australians aged 65 and above receive some form of Government Age Pension. The Age Pension is a payment you can get every two weeks after you retire, if you qualify. It can give you extra money.

To get the Age Pension, you need to meet age and residency rules and pass tests for income and assets. If you’re eligible, your Age Pension payments can supplement your income payments from your super.

You can also compose your retirement income from personal savings and assets like real estate and stocks. It’s beneficial to comprehend the function your assets serve in your retirement strategy. For example, one option available to Australian homeowners is downsizing. If your retirement home is too large, you can sell it and put the money into your super.

Here’s a list of things that you can do for planning your future retirement!

Creating a backup fund is important for financial stability. This fund provides money for unexpected expenses like repairs, emergencies, or bills. It helps people prepare for unexpected situations and reduces worry about money.

A contingency fund serves the primary purpose of providing readily available cash that you can access immediately when needed. You should keep the fund separate from regular savings or investment accounts. This will allow for easy access without penalties or restrictions.

When considering the future, it is crucial to contemplate the arrangements for your belongings after your death. Thinking about how you would like to handle and care for your possessions is important. To ensure that you carry out your wishes effectively, you need to make important decisions and take necessary steps.

Having a will, powers of attorney, and a designated beneficiary for your superannuation is important for estate planning and ensuring your wishes are respected after death.

Securing a comfortable and worry-free retirement is a goal we all aspire to achieve. By considering these six key steps to set the foundation for a secure retirement, you are taking a proactive approach to your financial future. Remember, it’s never too early to start planning, and with careful consideration, disciplined saving, and informed decision-making, you can build a solid financial foundation that will support you throughout your retirement years.

Read more: Top 5 Biggest Retirement Planning Mistakes

Are you new to retirement planning and looking for ways to secure your financial future? If you’re not familiar with the concept of a Self Managed Super Fund (SMSF), you might be missing out on the benefits of a SMSF for managing your retirement savings. Explore the advantages of a SMSF to see how it can benefit your retirement strategy.

The information presented on this website is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind.

NGS Crypto is an authorised reseller of NGS Group blockchain mining packages. The information presented on this website (https://ngscrypto.com) is general information only. It should not be taken as constituting professional advice from the website owner – NGS Crypto PTY LTD (NGS Crypto). Any information regarding past performance and returns contained on this website should not be construed or interpreted as a prediction or opinion as to future performance and returns. NGS Crypto is not a financial adviser. All views and observations expressed by NGS Crypto on this website are for information purposes only, are general in nature and should not be treated as investment or financial advice of any kind. Before making an investment in crypto assets, you should consider seeking independent legal, financial, taxation or other such professional advice to check how the information on this website relates to your unique circumstances. NGS Crypto is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly, by use of this website. You can view our full terms & conditions by clicking here.

NGS Crypto is not affiliated, associated, authorized, endorsed by, or in any way officially connected with this NGS Super (ABN 73 549 180 515).

© 2024 NGS Crypto

NGS Crypto is an Authorised Reseller of NGS Group

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |